Amazon Marketplace Submit Vendor Payments

Version 23.4.8839

Version 23.4.8839

Amazon Marketplace Submit Vendor Payments

The Submit Vendor Payments action submits new invoices to Amazon Marketplace. This action belongs at the end of a flow.

User input for this action is provided solely through the input XML.

XML Mapping

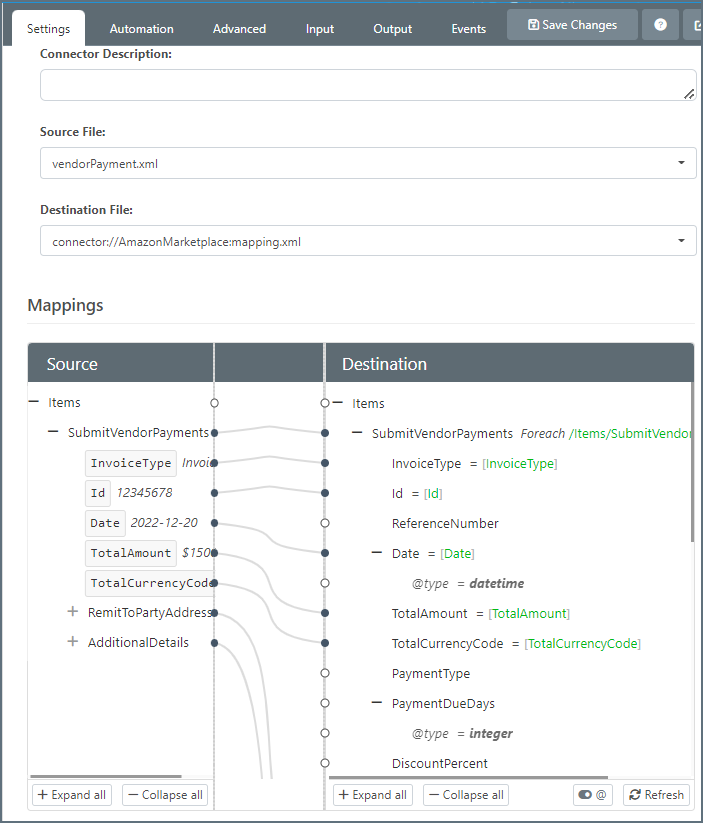

You must connect an XML Map connector to the Amazon Marketplace connector to map the required input parameters, as shown in the image below.

Input Parameters

The following table lists the input parameters that you can map with the XML Map connector interface.

| Name | Data Type | Required? | Description |

|---|---|---|---|

| Invoice Type | String | True | The type of invoice. Allowed values are Invoice and CreditNote. |

| Id | String | True | A unique number that relates to the charge details that are defined later in this table. This Id is the invoice number (if the document type is Invoice) or the credit-note number (if the document type is CreditNote). |

| ReferenceNumber | String | False | An additional unique reference number that is used for regulatory or other purposes. |

| Date | Datetime | True | A date and time in ISO 8601 format. |

| TotalAmount | String | True | The total amount of the invoice as a decimal number with no loss of precision. |

| TotalCurrencyCode | String | True | A three-digit currency code in ISO 4217 format. |

| PaymentType | String | False | The payment term type for the invoice. Allowed values are Basic, EndOfMonth, FixedDate, Proximo, PaymentDueUponReceiptOfInvoice, LetterofCredit. |

| PaymentDueDays | Integer | False | The number of calendar days from the base date (invoice date) until the total amount on the invoice is due. |

| DiscountPercent | String | False | The discount percentages as a decimal number with no loss of precision. |

| DiscountDueDays | Integer | False | The number of calendar days from the base date (invoice date) until the discount is no longer valid. |

| RemitToPartyId | String | True | The assigned identification for the party. |

| RemitToPartyAddress | Aggregate | False | The physical address of the person, business, or institution. |

| RemitToPartyAddress/Name | String | True | The name of the person, business, or institution at that address. |

| RemitToPartyAddress/AddressLine1 | String | True | The first line of the person, business, or institution’s street address. |

| RemitToPartyAddress/AddressLine2 | String | False | Additional address information (if required). |

| RemitToPartyAddress/AddressLine3 | String | False | Additional address information (if required). |

| RemitToPartyAddress/City | String | False | The city where the person, business, or institution is located. |

| RemitToPartyAddress/County | String | False | The county where the person, business, or institution is located. |

| RemitToPartyAddress/District | String | False | The district where the person, business, or institution is located. |

| RemitToPartyAddress/StateOrRegion | String | False | The state or region where the person, business, or institution is located. |

| RemitToPartyAddress/PostalOrZipCode | String | False | The postal or ZIP code for the address of the person, business, or institution. This code consists of a series of letters, digits, or both, sometimes including spaces or punctuation. |

| RemitToPartyAddress/CountryCode | String | True | The two-digit country code in ISO 3166-1 alpha-2 format. |

| RemitToPartyAddress/Phone | String | False | The phone number of the person, business, or institution that is located at that address. |

| RemitToPartyTaxDetails | Aggregate | False | The tax registration details of the party. |

| RemitToPartyTaxDetails/RegistrationType | String | True | The tax registration type for the entity. Allowed values are VAT (the value-added tax) and GST (the goods-and-services tax). |

| GST: Goods and services tax. | |||

| RemitToPartyTaxDetails/RegistrationNumber | String | True | The tax registration number for the entity (for example, the VAT Id). |

| ShipToPartyID | String | False | The assigned identification for the party. |

| ShipToPartyAddress | Aggregate | False | The physical shipping address of the person, business, or institution. |

| ShipToPartyAddress/Name | String | True | The name of the person, business, or institution at the shipping address. |

| ShipToPartyAddress/AddressLine1 | String | True | The first line of the person, business, or institution’s street address. |

| ShipToPartyAddress/AddressLine2 | String | False | Additional address information (if required). |

| ShipToPartyAddress/AddressLine3 | String | False | Additional address information (if required). |

| ShipToPartyAddress/City | String | False | The city where the person, business, or institution is located. |

| ShipToPartyAddress/County | String | False | The county where the person, business, or institution is located. |

| ShipToPartyAddress/District | String | False | The district where the person, business, or institution is located. |

| ShipToPartyAddress/StateOrRegion | String | False | The state or region where the person, business, or institution is located. |

| ShipToPartyAddress/PostalOrZipCode | String | False | The postal or ZIP code for the address of the person, business, or institution. This code consists of a series of letters, digits, or both, sometimes including spaces or punctuation. |

| ShipToPartyAddress/CountryCode | String | True | The two-digit country code in ISO 3166-1 alpha-2 format. |

| ShipToPartyAddress/Phone | String | False | The phone number of the person, business, or institution that is located at the shipping address. |

| ShipToPartyTaxDetails | Aggregate | False | The tax registration details of the party. |

| ShipToPartyTaxDetails/RegistrationType | String | True | The tax registration type for the party. Allowed values are VAT (the value-added tax) and GST (the goods-and-services tax). |

| ShipToPartyTaxDetails/RegistrationNumber | String | True | The tax registration number for the entity (for example, the VAT Id). |

| ShipFromPartyId | String | False | The assigned identification for the party. |

| ShipFromPartyAddress | Aggregate | False | The physical address of the shipper. |

| ShipFromPartyAddress/Name | String | True | The name of the shipper. |

| ShipFromPartyAddress/AddressLine1 | String | True | The first line of the shipper’s street address. |

| ShipFromPartyAddress/AddressLine2 | String | False | Additional address information (if required). |

| ShipFromPartyAddress/AddressLine3 | String | False | Additional address information (if required). |

| ShipFromPartyAddress/City | String | False | The city where the shipper is located. |

| ShipFromPartyAddress/County | String | False | The county where the shipper is located. |

| ShipFromPartyAddress/District | String | False | The district where the shipper is located. |

| ShipFromPartyAddress/StateOrRegion | String | False | The state or region where the shipper is located. |

| ShipFromPartyAddress/PostalOrZipCode | String | False | The postal or ZIP code for the shipper’s address. This code consists of a series of letters, digits, or both, sometimes including spaces or punctuation. |

| ShipFromPartyAddress/CountryCode | String | True | The two-digit country code in ISO 3166-1 alpha-2 format. |

| ShipFromPartyAddress/Phone | String | False | The shipper’s phone number. |

| ShipFromPartyTaxDetails | Aggregate | False | The tax registration details of the party. |

| ShipFromPartyTaxDetails/RegistrationType | String | True | The tax registration type for the party. Allowed values are VAT (the value-added tax) and GST (the goods-and-services tax). |

| ShipFromPartyTaxDetails/RegistrationNumber | String | True | The tax registration number for the party (for example, the VAT Id). |

| BillToPartyId | String | False | The assigned identification for the party. |

| BillToPartyAddress | Aggregate | False | The physical address of the party that is to be billed. |

| BillToPartyAddress/Name | String | True | The name of the party that is to be billed. |

| BillToPartyAddress/AddressLine1 | String | True | The first line of the party’s street address. |

| BillToPartyAddress/AddressLine2 | String | False | Additional address information (if required). |

| BillToPartyAddress/AddressLine3 | String | False | Additional address information (if required). |

| BillToPartyAddress/City | String | False | The city where the party that is to be billed is located. |

| BillToPartyAddress/County | String | False | The county where the party that is to be billed is located. |

| BillToPartyAddress/District | String | False | The district where the party that is to be billed is located. |

| BillToPartyAddress/StateOrRegion | String | False | The state or region where the party that is to be billed is located. |

| BillToPartyAddress/PostalOrZipCode | String | False | The postal or ZIP code for the address of the party that is to be billed. This code consists of a series of letters, digits, or both, sometimes including spaces or punctuation. |

| BillToPartyAddress/CountryCode | String | True | The two-digit country code in ISO 3166-1 alpha-2 format. |

| BillToPartyAddress/Phone | String | False | The phone number for the party that is to be billed. |

| BillToPartyTaxDetails | Aggregate | False | The tax registration details of the party that is to be billed. |

| BillToPartyTaxDetails/RegistrationType | String | True | The tax registration type for the party that is to be billed. Allowed values are VAT (the value-added tax) and GST (the goods-and-services tax). |

| BillToPartyTaxDetails/RegistrationNumber | String | True | The tax registration number for the party that is to be billed (for example, the VAT Id). |

| TaxDetails | Aggregate | False | The total tax-amount details for all line items. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| AdditionalDetails | Aggregate | False | Additional details provided by the selling party, for tax related or other purposes. |

| AdditionalDetails/Type | String | True | The three-digit currency code in ISO 4217 format. |

| AdditionalDetails/Detail | String | True | The details of the additional information that is provided by the selling party. |

| AdditionalDetails/LanguageCode | String | False | The language code of the additional-information details. |

| ChargeDetails | Aggregate | False | The details for the total charge amount for all line items. |

| ChargeDetails/Type | String | True | The three-digit currency code in ISO 4217 format. |

| ChargeDetails/Description | String | False | A description of the charge. |

| ChargeDetails/ChargeAmount | String | True | The charge amount as a decimal number with no loss of precision. |

| ChargeDetails/ChargeCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| ChargeDetails/TaxDetails | Aggregate | True | The details for the tax amount that is applied on this charge. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| AllowanceDetails | Aggregate | False | The details for the total allowance amount for all line items. |

| AllowanceDetails/Type | String | True | The type of allowance that is applied. Allowed values are Discount, DiscountIncentive, Defective, Promotional, UnsaleableMerchandise, and Special . |

| AllowanceDetails/Description | String | False | A description of the allowance. |

| AllowanceDetails/AllowanceAmount | String | True | The allowance amount as a decimal number with no loss of precision. |

| AllowanceDetails/AllowanceCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| AllowanceDetails/TaxDetails | Aggregate | False | The details for the tax amount that is applied on this allowance. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| InvoiceItem | Aggregate | False | The list of invoice items. |

| InvoiceItem/ItemSequenceNumber | Integer | True | A unique number that is related to this line item. |

| InvoiceItem/AmazonProductIdentifier | String | False | The Amazon Standard Identification Number (ASIN) of an item. |

| InvoiceItem/VendorProductIdentifier | String | False | The vendor-selected product identifier of the item. This identifier should be the same as the one that is provided in the purchase order. |

| InvoiceItem/PurchaseOrderNumber | String | False | The Amazon purchase-order number for this invoiced line item. The purchase-order number should be an eight-character alphanumeric code. This value is mandatory only when the invoice type is Invoice. |

| InvoiceItem/HsnCode | String | False | The HSN tax code. The HSN number cannot contain alphabetic characters. |

| InvoiceItem/InvoicedQuantityAmount | String | True | The quantity of an item. This value should not be zero. |

| InvoiceItem/InvoicedQuantityUnit | String | False | The unit of measure for the quantity. Allowed values are Cases and Eaches. |

| InvoiceItem/InvoicedQuantityUnitSize | Integer | False | The case size (if the unit-of-measure value is Cases). |

| InvoiceItem/NetCostAmount | String | True | The net cost amount as a decimal number with no loss of precision. |

| InvoiceItem/NetCostCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| InvoiceItem/CreditNoteReferenceInvoiceNumber | String | False | The original invoice number when you send a credit note that is related to an existing invoice. Only one invoice should be processed per credit note. This invoice number is mandatory for AP credit notes. |

| InvoiceItem/CreditNoteDebitNoteNumber | String | False | The debit note number as generated by Amazon. This number is recommended for Returns and COOP credit notes. |

| InvoiceItem/CreditNoteReturnsReferenceNumber | String | False | A number that identifies the returns notice number. This number is mandatory for all Returns credit notes. |

| InvoiceItem/CreditNoteGoodsReturnDate | String | False | A date and time that is defined according to ISO 8601. |

| InvoiceItem/CreditNoteRMAId | String | False | The Returned Merchandise Authorization Id (if one is generated). |

| InvoiceItem/CreditNoteCoopReference | String | False | The COOP reference number that is used for COOP agreement. Failure to provide the COOP reference number or the debit-note number might lead to a rejection of the credit note. |

| InvoiceItem/CreditNoteConsignorsReferenceNumber | String | False | The consignor reference number (VRET number) if one is generated by Amazon. |

| InvoiceItem/TaxDetails | Aggregate | False | The individual tax details per line item. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| InvoiceItem/ChargeDetails | String | False | The individual tax details per line item. |

| ChargeDetails/Type | String | True | The three-digit currency code in ISO 4217 format. |

| ChargeDetails/Description | String | False | A description of the charge. |

| ChargeDetails/ChargeAmount | String | True | The charge amount as a decimal number with no loss of precision. |

| ChargeDetails/ChargeCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| ChargeDetails/TaxDetails | Aggregate | False | The details of the tax amount that is applied on this charge. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| InvoiceItem/AllowanceDetails | Aggregate | False | The individual allowance details per line item. |

| AllowanceDetails/Type | String | True | The type of allowance that is applied. Allowed values are Discount, DiscountIncentive, Defective, Promotional, UnsaleableMerchandise, and Special . |

| AllowanceDetails/Description | String | False | A description of the allowance. |

| AllowanceDetails/AllowanceAmount | String | True | The allowance amount as a decimal number with no loss of precision. |

| AllowanceDetails/AllowanceCurrencyCode | String | True | The three-digit currency code in ISO 4217 format. |

| AllowanceDetails/TaxDetails | Aggregate | False | The details for the tax amount that is applied on this allowance. |

| TaxDetails/Type | String | True | The type of the tax that is applied. Allowed values are CGST, SGST, CESS, UTGST, IGST, MwSt, PST, TVA, VAT, GST, ST, Consumption, MutuallyDefined, and DomesticVAT. |

| TaxDetails/TaxRate | String | False | The tax rate as a decimal number with no loss of precision. |

| TaxDetails/TaxAmount | String | True | The tax amount as a decimal number with no loss of precision. |

| TaxDetails/TaxCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |

| TaxDetails/TaxableAmount | String | False | The taxable amount as a decimal number with no loss of precision. |

| TaxDetails/TaxableCurrencyCode | String | False | The three-digit currency code in ISO 4217 format. |